8 Easy Facts About How Do I Become An Insurance Agent Shown

Consider your household's needs and top priorities when finding out the quantity of life insurance coverage to acquire. Do you have financial obligations to pay? Will your household have to change your income to fulfill daily living costs? Do you desire to fund a college education for your children? Although you may have some life insurance through your job, it's typically an excellent concept to have your own policy in addition to the life insurance supplied by your employer.

Financial obligation and earnings replacement calculators can assist you decide just how much life insurance you need prior to you get quotes. Here's a calculator to get you started. Life insurance coverage is a long-lasting purchase, and you desire a business that can pay claims many years in the future. The biggest life insurance coverage business have long track records, but some smaller sized insurance companies are solid competitors too.

Finest or Standard & Poor's. NerdWallet advises avoiding insurers with an A.M. Finest rating of B or lower, if possible. NerdWallet's ranking of the finest life insurance coverage business likewise offers points to companies that have greater client fulfillment ratings and fewer problems to state regulators. Not all companies sell the same types of policies, and some focus on specific products, such as life insurance coverage policies for kids.

Collect the information you need to obtain term life insurance coverage or an irreversible policy before you begin the application process. You'll likely need to offer info about your existing and previous health conditions, in addition to your household's health history. The insurance provider might need your grant get medical records and ask you to take a life insurance medical examination.

The Best Strategy To Use For How Much Is Aarp Term Life Insurance?

You'll need to choose recipients, who will get the payment when you die. Make sure you have their Social Security numbers and dates of birth. You likewise may need to address questions about criminal convictions and driving infractions such as a suspended motorist's license or DUI, especially if they happened within the past couple of years - which of these life insurance riders allows the applicant to have excess coverage?.

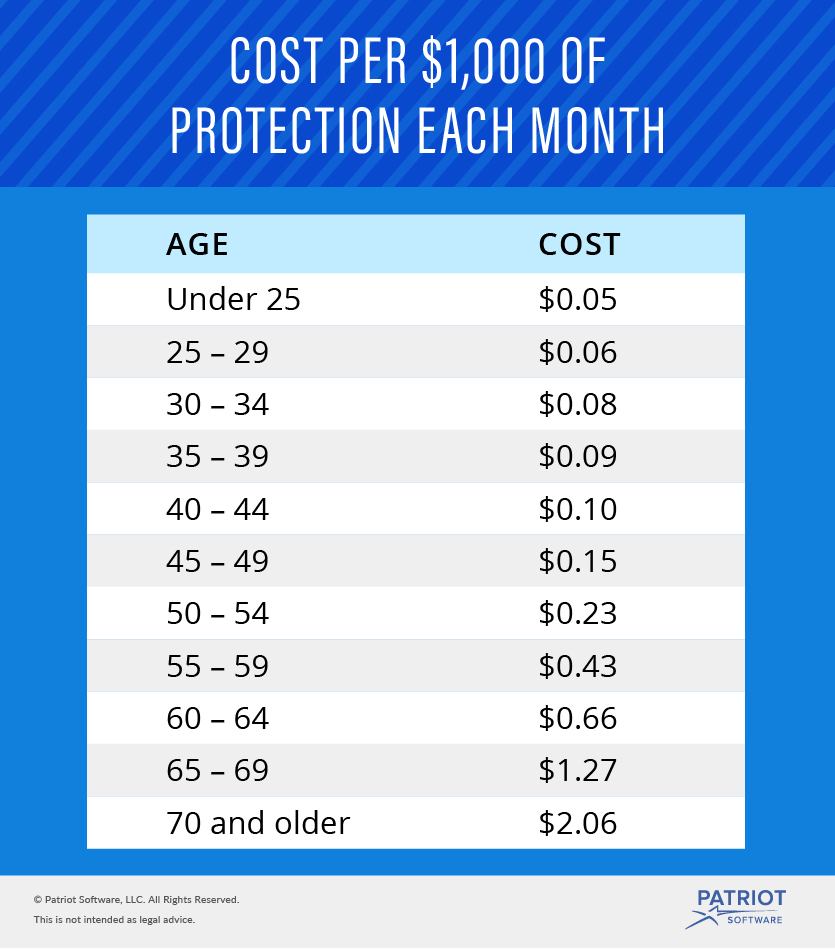

To find the best rate for you, be sure to compare life Find more info insurance coverage prices estimate from several business. Prices can vary extensively, depending upon the type of coverage you select and personal factors such as your age, gender and health. Life insurance business use life span as the basis for identifying rates.

So it's smart to buy life insurance coverage as early as possible, when you're young and healthy. If you wait, your life insurance coverage quotes will increase exclusively because of your age. If brand-new health issues develop, your rates might go up much more. You can still get life insurance coverage if you have a medical condition.

NerdWallet is a complimentary tool to discover you the finest credit cards, cd rates, savings, inspecting accounts, scholarships, health care and airline companies. Start here to maximize your benefits or decrease your rates of interest. Get immediate quotes for term life insurance coverage. See a cost comparison for several carriers.

Everything about How To Cancel Life Insurance

When you apply for life insurance, the underwriting process examines how risky of a candidate you are to identify just how much you will spend for life insurance premiums. If you work that puts you at threat or have any harmful hobbies, such as sky diving or scuba diving, https://www.benzinga.com/pressreleases/20/02/p15374673/34-companies-named-2020-best-places-to-work you can expect to see higher life insurance coverage premiums.

A skydiver with a $1,000,000 policy might wind up paying an additional flat additional fee of $5,000 each year. However, somebody who skydives excessive might not be able to purchase life insurance coverage with specific carriers at all. A Policygenius consultant can assist you identify the finest provider alternatives based on your hobbies and how often you take part in them.

If your life insurance carrier finds out that you pushed the application, they can invalidate your coverage when you die and not pay out the survivor benefit to your recipients. The underwriting process basically examines the length of time you will live to identify how much you pay for life insurance premiums.

The chart below programs the distinction in life insurance coverage premiums in between men and females for a 20-year term policy. AGE $250,000$ 500,000$ 750,000$ 1 MILLION$ 2 MILLION20Male$ 18.33$ 28.52$ 40.02$ 47.23$ 86.79 Female$ 14.52$ 21.60$ 29.56$ 34.66$ 63.5225 Male$ 17.45$ 27.57$ 38.59$ 45.84$ 85.74 Female$ 14.56$ 21.69$ 29.69$ 35.19$ 64.7630 Male$ 17.94$ 28.58$ 40.11$ 47.48$ 89.30 Female$ 15.28$ 23.06$ 31.22$ 37.02$ 68.9735 Male$ 19.15$ 31.02$ 43.75$ 52.20$ 98.57 Female$ 16.86$ 26.08$ 36.36$ 42.67$ 79.4240 Male$ 24.83$ 41.00$ 58.52$ 72.41$ 139.08 Female$ 21.26$ 34.03$ 48.29$ 58. how to find a life insurance policy exists.97$ 112.1945 Male$ 35.87$ 61.21$ 89.11$ 113.21$ 220.65 Female$ 28.80$ 47.85$ 69.20$ 86.01$ 166.4950 Male$ 54.07$ 95.07$ 139.23$ 177.31$ 348.71 Female$ 42.18$ 71.38$ 103.98$ 131.43$ 255.4855 Male$ 85.81$ 150.94$ 220.28$ 279.98$ 546.91 Female$ 60.88$ 107.71$ 157.48$ 204.52$ 403.5060 Male$ 147.80$ 260.05$ 380.00$ 486.53$ 967.52 Female$ 108.05$ 185.92$ 272.88$ 345.23$ 685.49 At this time, there is no established procedure on gender for transgender applicants. While usually carriers will provide policies based on your actual gender instead of the gender you were appointed at birth, it's unfortunately up to the underwriter to make this determination.

Everything about What Does Life Insurance Cover

Although the underwriting procedure represent factors like age and gender, life insurance coverage business can not victimize race, ethnic culture or sexual orientation as identifying factors during the underwriting procedure. Here are some other factors that will not impact just how much you spend for life insurance coverage: As long as you live within the U.S., the state or city you reside in doesn't impact your premium prices.

However because life insurance is state-regulated, where you live can determine specific rules and guidelines connected to your policy. Lots of people pick to name several life insurance coverage recipients in their life insurance coverage policies. Your premiums won't increase or reduce based upon the number of beneficiaries you name, whether you have one or several.

Often, stacking (or laddering) multiple policies can even save you cash long term. If you end up getting protection from numerous policies, your premiums for any single policy won't increase based upon the number of overall life insurance coverage policies you hold. The expense of your life insurance coverage policy depends upon five factors: the type of policy you get, health, age, pastimes and gender.

In addition, men tend to see higher premiums than females. For instance, a healthy 35-year-old male can expect to pay about $49 monthly on life insurance coverage premiums, while a healthy 35-year-old female can anticipate to pay about $40 per month for a term life insurance coverage policy. Picking a permanent life insurance policy over a term life insurance policy will likewise increase your rates.

The Definitive Guide for How To Pass Life Insurance Medical Exam

by Louis Wilson If you're asking yourself whether life insurance coverage deserves it, the response is easy. Yes, life insurance coverage deserves it especially if you have enjoyed ones who rely on you financially. Life insurance coverage serves as an important financial safeguard if you were to pass away all of a sudden.

Find out more about term life insurance, how it works and why it may be a fundamental part of your monetary plan. Term life insurance is worth it if you're seeking to help make sure financial security for your family at an affordable price. It's a basic, budget friendly kind of life insurance strategy that covers your household for a set period of time, typically 10, 15, Learn here 20 or 30 years.

For instance, until the kids are grownups or your mortgage is paid off. Determining which term length you require is actually really easy. You can utilize an online life insurance calculator to get a suggestion on a coverage amount and term length that might best fit your financial scenario. In exchange for monthly or annual premiums paid for the period of the term length, a life insurance policy supplies monetary protection to your household.