The Only Guide to How Do I Get Health Insurance</h1><h1 style="clear:both" id="content-section-0">6 Easy Facts About How Long Do You Have To Have Life Insurance Before You Die Explained

If you purchase a level term life insurance policy, like Haven Term, the term life rates remain the same throughout the term of your policy, even if it lasts for thirty years. For example, a 35-year-old guy in exceptional health can get a $500,000, 20-year Haven Term policy, provided by MassMutual, by paying a regular monthly premium of about $23.

That's a difference of about $108 a year and nearly $1,300 throughout the life of the policy. Your health is another crucial element that underwriters utilize to compute your premium. You'll be inquired about your health history, your prescriptions, your pre-existing conditions and even your household's case history when you use.

Underwriters also think about things like your profession and your hobbies. If you're a roofing professional, expect to pay a greater premium than an accountant or a college teacher. If you go out searching on the weekend, you'll have a greater premium than somebody who collects stamps. As soon as you have your coverage in place, paying premiums ends up being a practice and you probably won't think far more about them.

You can subtract your mortgage interest, your trainee loan interest and your contributions to the food kitchen on your income taxes, so what about your life insurance premiums? In many cases, the response is no. But there is good tax news related to life insurance. If you died and your family filed a claim to get your coverage, generally the payment would be tax-free.

With something like completely medically underwritten term life insurance, your premium is custom-built for you based on the info underwriters have gathered from your application, medical examination and other databases. And while you can't price haggle for your life insurance premium, you can (and should) search. When you do this, ensure you take notice of the ratings your life insurance company has earned.

Best or Moody's, then you'll feel less confident about the life insurance company's claims-paying ability. And do not forget there's a lot you can do to get a lower premium before you get to the underwriting phase. Living a healthy lifestyle for beginners, but likewise making certain you're getting the term length and the protection amount that are best for your needs.

The Basic Principles Of How Much Is A Doctor Visit Without Insurance

This assists life insurance providers offer an estimate, giving you a concept of what your premiums would be. Nevertheless, until you go through the underwriting procedure, there's no chance to offer life insurance prices estimate that are guaranteed to match your premium. That's due to the fact that the underwriting procedure may expose something you didn't know about your health.

Or perhaps you've had a couple of speeding tickets in the past couple years (the amount you pay your insurer for your insurance plan is which of the following?). In that case, you're a greater danger to the insurance provider than your initial details suggested, so your premium will be greater. In addition to providing you with a quote, Haven Helpful site Life makes it easy and practical to use online meaning you can get your genuine rate anytime, anywhere and from any gadget.

The premiums you pay become earnings for your insurance provider. Like any business's earnings, the cash spends for everyday operations. Your premiums also help pay claims to the beneficiaries of other policyholders who are going through the grief of losing their liked one. Insurance coverage business invest the rest of their earnings from premiums to maximize revenues.

High ratings, such as those of Sanctuary Life's moms and dad business MassMutual, indicate each score company's viewpoint about the health of their long-lasting service practices and the probability they'll be around when you need to submit a claim. Don't be shy about looking into these rankings prior to purchasing your protection. A life insurance premium is a payment, much like the home mortgage, the energies, the trainee loans, and Netflix.

They 'd use an entrance to monetary stability for your liked ones. That is essential things, however it does not indicate you ought to put your monthly budget at risk by taking on Go to this website an expensive premium to make it take place. Search, identify your actual life insurance needs, lock in a term life rate that benefits from your existing youth and good health.

Financial strength ratings for MassMutual are as of Might 29, 2019: A.M. Finest Company: A++ (Superior; leading classification of 15); Fitch Ratings: AA+ (Very Strong; 2nd category of 21); Moody's Investors Service: Aa3 (High Quality; 4th classification of 21); Requirement & Poor's: AA+ (Really Strong, 2nd classification of 21). Scores are for MassMutual (Springfield, MA 01111) and its subsidiaries, C.M.

The Main Principles Of How Does Long Term Care Insurance Work

and MML Bay State Life Insurance Coverage Co. (Enfield, CT 06082). Ratings are subject to alter. Ratings do not apply to Sanctuary Life Insurance Company.

Ever go to a celebration and, while you're making little talk, someone arbitrarily says, "Hey, you people you understand what's really cool? Insurance premiums." Okay, that's most likely never took place since that would be odd. You 'd all stare blankly at each other, like, Why is this man talking about insurance coverage premiums at a celebration? If it ever did occur, you 'd smartly excuse yourself and go find a new group of buddies talking about religious beliefs or politics.

However, still, a seed would be planted, and then you would absolutely need to know what an insurance coverage premium is. In a nutshell, an insurance premium is the payment or installment you consent to pay a business in order to have insurance. You get in into a contract with an insurance company that ensures payment in case of damage or loss and, for this, you accept pay them a specific, smaller quantity of money.

So, how do insurance provider come up with the cost of the premium? Well, first, individuals called actuaries work for insurer to identify the specific risks associated with a policy - how long can i stay on my parents health insurance. They take a look at things like how most likely a catastrophe or mishap is, and the likelihood of a claim being submitted, and how much the company will be on the hook for paying out if a claim is filed.

Now, the underwriter uses this data in addition to details offered by the person or business requesting insurance coverage when they issue a policy to identify what the precise premium will be for the amount of protection they want. While all insurance works in the very same fundamental method, in order to keep this discussion from ending up being too abstract, let's look at how insurance coverage companies figure out superior quantities for a few various kinds of insurance.

The insurer might likewise look at whether you park your automobile in a garage. Underwriters also consider your driving record to see how big of a risk you are to insure. If you have a lot of speeding tickets or you have actually been in a bunch of accidents, your premiums will be more costly than those for a person who does not. Insurance companies sometimes utilize information from medical claims to get detailed information about the care provided by private suppliers (a treatment referred to as service provider profiling). That information is then used to provide feedback to service providers on how their practice patterns compare with those of their peers and to recognize suppliers who are furnishing inappropriate or excessive care (and who may be gotten rid of from the plan's network as an outcome).

The Facts About How Much Renters Insurance Do I Need Revealed

Sometimes, plans likewise use differences in cost-sharing requirements or other strategies to affect consumers' options within their approved networks or series of covered treatments and services. For instance, strategies usually develop a drug formulary or list of drugs that the strategy covers (which belongs to a provider network).

Plans also encourage enrollees to utilize lower-cost generic variations of drugs when they are available, by setting the most affordable copayment quantities for those drugs. More just recently, some plans have started utilizing the information gathered from service provider profiling to designate a chosen "tier" of providers based upon quality and cost standards.

In addition, enrollees might be offered financial incentivessuch as lower cost-sharing requirementsto get their care from higher-tier companies. Determining the impacts of the different cost-containment tools can be hard due to the fact that health strategies utilize various combinations of them, and plans differ along a number of other measurements. Consequently, much of the released research study has actually focused on comparing HMOs (which have traditionally utilized more rigid cost-containment techniques) with other types of strategies.

In specific, studies have actually discovered that HMOs decrease the usage of medical facility services and other expensive services. Because those studies rely largely on data that are more than a decade old, nevertheless, they probably overemphasize the differences that exist today between HMOs and other kinds of strategies. On the basis of the available evidence, CBO estimates that plans making more extensive use of benefit-management strategies would have premiums that are 5 percent to 10 percent lower than plans utilizing very little management strategies. which of the following typically have the highest auto insurance premiums?.

Before 1993, healthcare spending usually grew at a faster rate than gdp. From 1993 to 2000, the share of employees with private health insurance coverage who were registered in some type of handled care strategy rose from 54 percent to 92 percent. During that duration, overall spending for healthcare stayed almost constant as a share of the economy, at about 13.

Lots of experts believe that the growth in managed care strategies contributed considerably to the downturn in the development of healthcare spending throughout that duration. By the end of the 1990s, opposition to the restrictions enforced by managed care strategies was growing amongst customers and providers. The strategies reacted by unwinding those constraints, and enrollment moved to more loosely managed PPO strategies.

The Definitive Guide for How Much Does Gap Insurance Cost

0 percent of GDP in 2006. Other aspects, nevertheless, have unquestionably added to the growth in health care spending relative to the size of the economy because 2000; hospital mergers became more prevalent, for example, improving medical facilities' utilize in working out with health insurance. Proposals to change the medical insurance market or to subsidize insurance coverage purchases may consist of provisions impacting the management of health plans.

Although legislators did not enact those propositions, some states adopted similar provisions restricting health insurance companies that run in their jurisdiction. (As talked about in Chapter 1, prepares bought in the individual insurance coverage market and the majority of strategies bought by smaller sized employers undergo state policies, whereas most of plans provided by bigger employers are exempt.) In modeling the results of such propositions, CBO considers the nature of any provisions governing the strategy's structure, utilization management, and provider networks and their interaction with existing state requirements.

Under some proposals, insurers would be needed to cover specific kinds of care, such as check outs to experts, without a referral from an enrollee's main care doctor. Previous propositions also would have granted enrollees rights of redress, allowing those who had been rejected protection for a particular service to appeal the choice or pursue other remedies in civil courts.

Other arrangements could also manage insurance companies' networks of companies. Any-willing-provider laws require that health strategies consist of in their network any provider who accepts follow the terms and conditions of the plan's agreement. Lots of states enacted such laws in the 1990s, but those laws do not apply to employment-based strategies that are exempt from state guideline.

In its previous analyses of proposals to create a Clients' Bill of Rights in 1999 and 2001, CBO typically identified that a number of their provisionswhich are comparable to those described abovewould boost spending on health care. Since then, nevertheless, lots of health plans have dropped certain cost-containment treatments or changed them with other techniques; to the level that such changes were not expected, the magnitude of CBO's estimates of the effects of brand-new propositions that affect strategies' management strategies may differ from its previous findings.

For instance, CBO estimated that a federal any-willing-provider law or federal network-adequacy requirements and propositions needing strategies to cover particular kinds of careincluding sees to specialists without prior permission, sees to an emergency situation room if a "sensible layperson" would have related to the client's condition as an emergency, and the regular expenses of enrollment in authorized medical trialswould, in combination, have increased personal medical insurance premiums by quantities ranging from 1.

The Ultimate Guide To How Much Is Average Car Insurance

7 percent. If reintroduced today, however, similar arrangements would probably have a smaller sized effect on premiums; to an extent not prepared for in CBO's initial estimates, numerous health plans have acceded to customers' preferences for wider access to care by expanding the size of their service provider networks and getting rid of or minimizing a few of their constraints on the usage of covered services.

For circumstances, the results of proposals to expand enrollees' access to the courts for pursuing civil remedies to settle disagreements with insurance companies would probably resemble the effects that were estimated in 2001 since the expectation in the initial price quotes that the legal environment would not change considerably has, so far, proved to be accurate.

1 percent to 1. 7 percent. Propositions to change the policy of insurance marketsas well as numerous other kinds of proposalscould impact the expenses of medical insurance by changing the administrative costs of health insurance (often referred to as "administrative load"). In this discussion, administrative expenses refer to any costs insurers incur that are not payments for health care services, including the earnings retained by personal insurance providers and the taxes paid on those revenues.

( Underwriting includes an evaluation of an applicant's health and expected usage of health care in order to identify what premium to charge.) Costs associated with medical activities consist of expenses for Additional info claims review and processing, medical management (such as utilization evaluation, case management, quality control, and regulative compliance), and company and network management (contracting with medical professionals and health centers and preserving relations with companies).

Top Guidelines Of How Much Should I Be Paying For Car Insurance</h1><h1 style="clear:both" id="content-section-0">How Much Home Insurance Do I Need Can Be Fun For Everyone

Your insurance company will protect you if you are sued, however they may suggest that you get a lawyer. Why? Keep in mind that your insurer is just at risk for its policy limit. You are accountable for any remaining amount. For example, if you are taken legal action against for $1 million and your policy limitation is only $300,000, you are accountable for $700,000.

Like the motorist, gather very important informationnames, addresses, license numbers, policy numbers, and so on. How much you will gather for damages depends upon how well guaranteed the other chauffeurs are. As a passenger, you can collect for damages from one of 2 ways: 1) under your driver's medical payments coverage or 2) submitting a claim versus the at-fault chauffeur's liability coverage.

Yes, unless you sign an agreement that releases the insurer from paying you additional money. A. If your automobile is stated an overall loss, your insurance coverage company will pay you for its value by utilizing referrals such as the "blue book" and/or by consulting cars and truck dealerships. Understand that the specific condition of your vehicle, http://www.williamsonhomepage.com/brentwood/wesley-financial-group-providing-scholarships-for-students-from-single-parent-households/article_36f44986-eef2-11ea-b3c2-73d73b7dbc10.html consisting of mileage or the tires, affects just how much your automobile deserves.

A. You ought to report all mishaps even if you don't wind up suing. If you do not report it, you run the danger of being taken legal action against by the other individuals associated with the accident and your insurance coverage business will be at a downside in defending you. A. Under most scenarios, someone utilizing your automobile with your consent is covered by your insurance coverage.

Some Ideas on How To Cancel State Farm Insurance You Need To Know

A. If you are not at fault in the crash, your insurance coverage is usually not affected. If you are at fault, get a ticket for a severe violation (i. e. dui) or are included in a pricey residential or commercial property damage claim (i. e. crash into a tree), your rates may increase at the time of policy renewal because you will be classified into a greater danger group of people.

danijelala/ Getty Images. If residential or commercial property insured under a commercial residential or commercial property policy is harmed, the insurance provider will figure out the quantity of loss based upon the product's real money value or its replacement expense, whichever uses. Cars insured for physical damage under https://www.springhopeenterprise.com/classifieds/wesley+financial+group+llc+timeshare+cancellation+experts+over+50000000+in+timeshare+debt+and+fees+cancelled+in,215406 an industrial car policy are valued based on their real money worth.

Do not presume that your insurance provider's price quote of these expenses is accurate. Repair and replacement expenses differ widely from place to location. Building and construction expenses in one area may be substantially greater than those in another. If you disagree with an adjuster's evaluation of a loss, let the insurance provider know. It might refer you to a consumer problem department.

Editorial Note: Credit Karma gets payment from third-party advertisers, however that does https://www.mytimeshareexitreviews.com/wesley-financial-group-review-cost-fees-ratings/ not affect our editors' viewpoints. Our marketing partners do not examine, authorize or endorse our editorial material. It's accurate to the finest of our understanding when posted. Schedule of items, functions and discounts may vary by state or territory - the amount you pay your insurer for your insurance plan is which of the following?. Read our Editorial Standards to read more about our team.

The Ultimate Guide To How Long Can My Child Stay On My Health Insurance

It's quite easy, really. The deals for monetary products you see on our platform come from business who pay us. The cash we make assists us give you access to totally free credit report and reports and helps us develop our other fantastic tools and instructional materials. Payment may factor into how and where products appear on our platform (and in what order).

That's why we supply features like your Approval Chances and savings estimates. Naturally, the deals on our platform do not represent all monetary products out there, however our goal is to show you as lots of terrific alternatives as we can. A variety of events could need you to take advantage of your insurance coverage.

To get your insurance benefits, you'll need to file a vehicle insurance claim. Here's what you need to understand and the actions you'll require to take to return on the road as quickly as possible. Paying too much for car insurance coverage? If there's been some sort of damage-causing incident, the very first thing to do is look after yourself and anybody around you.

Then, if you have actually been in a mishap, or if someone has gotten into, vandalized or taken your cars and truck, call the police. They can assist with safety and demand emergency services if needed. In some states, you're needed to call the police after an accident, so ensure you know the law in your location.

Fascination About How Long Does It Take For Gap Insurance To Pay

The authorities report can serve as a record of what occurred and assists ensure the insurer gets accurate details. You can check in with the authorities to get a copy of the report, oftentimes within a day or more of it being submitted. When something occurs to your vehicle, it's typical to feel shocked but it's necessary to stay focused on collecting precise, comprehensive details to submit your car insurance claim.

Note where and when the incident took place and get pictures of the scene, too, if possible - how to shop for health insurance. You'll require as much detail as possible for your claim. If there has been a natural catastrophe, bear in mind that even after a storm, fire or earthquake, the circumstance might threaten. Be cautious and wait until conditions are safe to document the damage.

A badge number and a phone number will help if you require to follow up and get more info later on in the claims procedure. If your vehicle has actually been stolen, offer the police a comprehensive description of your car and license plate number. Share your automobile recognition number and registration number if you have them on hand.

If the damage is minor and there are no injuries, or if weather condition conditions are bad, they may not come. If that occurs, you can go to the police headquarters to submit a report as soon as possible. This may be required in some states if the damage goes beyond a certain quantity.

How Do I Know If I Have Gap Insurance Things To Know Before You Get This

The insurer may repay you for them, based on your coverage. You've most likely been informed to not confess fault at the scene of a traffic accident. That's great advice and it goes both methods. Leave determining fault to the authorities, whether you think you're to blame or somebody else.

Based upon your state's legal framework, the insurer can figure out how much fault if any each driver might hold. Document the other chauffeur's contact details, insurance company and policy number, make and design of the automobile, and license plate number and state. If possible, get the names of other travelers included, too.

The Buzz on How Much Does An Mri Cost With Insurance

These investments are an essential part of the Australian economy, supporting services, industries, facilities projects and the financial system. A lot of insurance companies are owned by investors (consisting of superannuation funds and mutual fund) and the insurance company has a commitment to offer them with a return on their investment. The Australian Prudential Regulation Authority (APRA) has guidelines needing insurers to have enough capital to pay a very high volume of claims.

Shopping around to discover the policy that best fits your specific circumstances can cause you finding a less expensive policy. Nevertheless, shopping on rate alone may lead to a policy that does not satisfy your particular requirements and leaves you financially exposed to particular threats. Decreasing your level of cover can decrease your premium, however it increases your threat of being underinsured.

Many insurance plan enable you to define an excess. In general, a higher excess will imply you pay a lower premium Lots of insurers will offer you a cheaper premium if you take actions to lower your risk. You may receive a discount rate on your house and contents policy if you have security devices in place such as window locks and deadlocked doors.

Offering additional details to the insurance provider about your specific threat may likewise permit your premium to be evaluated. You can also ask your insurer about how you might be able to lower your premium Each insurer will offer items that differ from those used by other insurance providers, with variations in thecoverage the terms and conditions, exclusions and expenses Some insurance companies may offer discount rates such as a no claims or multi-policy discount rate if you have 2 or more policies with one business If you pay your premium by instalments it normally costs you more than if you choose to pay your premium in one yearly swelling amount payment.

Updated November 30, 2020 Editorial Note: Credit Karma gets settlement from third-party advertisers, however that doesn't impact our editors' opinions. Our marketing partners do not examine, authorize or endorse our editorial material. It's accurate to the very best of our knowledge when published. Accessibility of items, features and discount rates might vary by state or territory.

We think it is very important for you to understand how we make cash. It's pretty easy, in fact. The deals for financial items you see on our platform come from companies who pay us. The money we make assists us give you access to free credit report and reports and assists us produce our other excellent tools and instructional materials.

However because we usually generate income when you discover a deal you like and get, we attempt to reveal you uses we think are an excellent match for you. That's why we supply functions like your Approval Chances and cost savings estimates. Obviously, the deals on our platform don't represent all financial items out there, but our goal is to show you as many terrific alternatives as we can.

Not known Facts About How Much Does Homeowners Insurance Cost

Let's take an appearance at how a cars and truck insurance premium works, the average insurance costs and the aspects that can impact your insurance rates. Need car insurance? Your premium is the amount of cash you pay to an insurance business to offer insurance coverage on your vehicle. Your cars and truck insurance coverage premium may be paid monthly, every 6 months, and even just when a year, depending upon the payment choices your cars and truck insurance provider uses.

Your cars and truck insurance coverage premium expenses are based partially on the kinds of insurance protection you choose, but other factors can impact your total cost (more on that later). In every state other than New Hampshire, you're needed to have a minimum quantity of coverage. This can help secure your wallet by covering expenses up to the coverage limit detailed in the policy you select for instance, to cover injuries or home damage you trigger another driver in an accident.

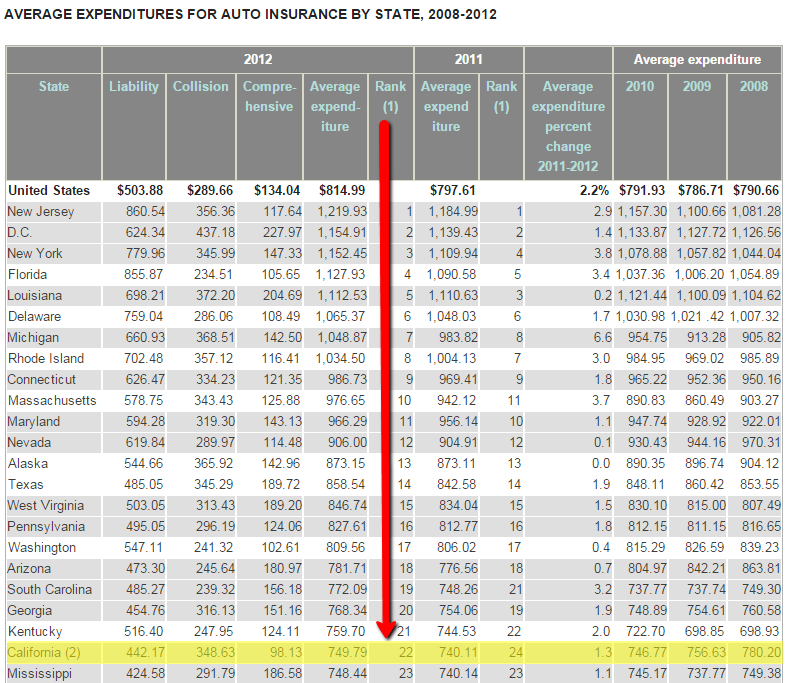

The average liability insurance premium across the country had to do with $538 in 2015, according to the 2017 Auto Insurance Coverage Database Report from the National Association of Insurance Coverage Commissioners, or NAIC. Averages differed from state to state, with a low of $298 in North Dakota and a high of practically $870 in New Jersey.

The expense of your car insurance premium can depend upon a number of different factors some of which you can manage (for instance, where you live or the kind of automobile you drive) and some that are out of your control (such as your age). Required car insurance coverage? Here are a few of the factors that might impact your car insurance coverage rates.

And choosing high protection limitations and/or low deductibles will likely increase your expense of cars and truck insurance, too. Are you an experienced chauffeur with no blemishes on your record? Or do you have a few tickets and an accident or 2 in your driving history? Even the amount of time you've been driving can impact your insurance coverage premium.

More youthful chauffeurs often pay more for insurance protection due to the fact that they have less experience on the road and are at greater risk of being involved in a mishap. When determining your premium, insurance provider consider a few elements connected to your car, such as the expense to fix it and general security record.

Insurance provider use your credit-based insurance score to forecast the likelihood of you remaining in an accident and filing a claim. However note that California, Massachusetts and Hawaii have actually all prohibited the use of credit-based insurance coverage ratings in figuring out insurance coverage premiums. Do you have a long everyday commute, or do you only drive to run errands on weekends? The more you drive, the higher your premium might be.

How Much Does Mortgage Insurance Cost Fundamentals Explained

Collect and compare insurance quotes from multiple automobile insurance coverage business to help you find the finest protection and rates for your requirements (how much does flood insurance cost). And be sure to ask about any prospective insurance coverage discount rates or other ways you may have the ability to lower the expense of your automobile insurance coverage premium. Need automobile insurance? Erik Deckers is an expert blogger and ghostwriter, and is the co-author of Branding Yourself, No Bullshit Social Media, and The Owned Media Doctrine.

Comprehending fundamental medical insurance terms can assist you pick the strategy that might be the right option for you. A health insurance premium is a monthly cost you pay each month for having medical http://deanacha822.almoheet-travel.com/our-how-to-file-an-insurance-claim-diaries insurance protection. Before picking a health insurance, carefully consider: Your present health Your typical yearly health care expenses Your offered yearly income for out-of-pocket medical costs Next, adjust your previous annual healthcare expenses for any modifications to your current health.

Strategies with low premiums typically don't start supplying protection up until you've paid out-of-pocket for a considerable part of your medical expenditures. Other plans might have greater regular monthly premiums, however cover a bigger part of your medical expenses., you are accountable for paying the full premium to your medical insurance business each month.

, your company may pay a portion of your premium. You'll be responsible for the remainder, which you can often set up to have actually deducted from your salary every month. You can not pay your medical insurance premium with funds from your health cost savings account (HSA). These tax-free funds can only be used for out-of-pocket medical costs.

Some Of Why Is Car Insurance So Expensive

They like understanding that when they need their insurance, they won't have to create a large amount of money prior to their strategy begins assisting with the cost. So they 'd rather have a greater premium, however a lower deductible. It makes your expenses more foreseeable.

A health insurance coverage premium is a monthly fee paid to an insurance provider or health insurance to supply health coverage. The scope of the coverage itself (i. e., the amount that it pays and the amount that you spend for health-related services such as medical professional visits, hospitalizations, prescriptions, and medications) varies considerably from one health insurance to another, and there's typically a correlation in between the premium and the scope of the coverage.

ERproductions Ltd/ Blend Images/ Getty Images In other words, the premium is the payment that you make to your http://www.wesleytimesharegroup.com/wesley-financial-group-chuck-mcdowell/ health insurance coverage business that keeps protection fully active; it's the quantity you pay to acquire your protection. The Premium payments have a due date plus a grace duration. If a premium is not totally paid by the end of the grace period, the health insurance coverage company may suspend or cancel the protection.

These are quantities that you pay when you require medical treatment. If you do not need any treatment, you won't pay a deductible, copays, or coinsurance. However you need to pay your premium each month, despite whether you utilize your health insurance or not. If you receive health care coverage through your job, your employer will typically pay some or all of the monthly premium.

They will then cover the rest of the premium. According to the Kaiser Household Foundation's 2019 employer advantages survey, employers paid an average of almost 83% of single staff members' total premiums, and approximately nearly 71% of the total household premiums for staff members who add member of the family to the strategy.

Not known Facts About How Much Do Dentures Cost Without Insurance

Nevertheless, considering that 2014, the Affordable Care Act (ACA) has supplied exceptional tax credits (aids) that are available to people who purchase private coverage through the exchange. In order to be eligible for the premium subsidies, your earnings can't exceed 400% of the federal poverty level, and you can't have access to affordable, comprehensive coverage from your employer or your spouse's employer - how much does motorcycle insurance cost.

Let's say that you have been investigating healthcare rates and plans in order to discover a plan that is affordable and ideal for you and your liked ones - what is a certificate of insurance. After much research, you eventually end up choosing a specific plan that costs $400 per month. That $400 monthly fee is your medical insurance premium.

If you are paying your premium by yourself, your monthly https://www.businesswire.com/news/home/20190911005618/en/Wesley-Financial-Group-Continues-Record-Breaking-Pace-Timeshare costs will come directly to you. If your employer offers a group medical insurance plan, the premiums will be paid to the insurance strategy by your company, although a portion of the overall premium will likely be collected from each staff member via payroll deduction (most large companies are self-insured, which suggests they cover their workers' medical costs directly, normally contracting with an insurance provider just to administer the strategy).

The staying balance of the premium will be invoiced to you, and you'll need to pay your share in order to keep your protection in force. Additionally, you can pick to pay the complete amount of the premium yourself each month and claim your total premium subsidy on your income tax return the following spring.

If you take the aid upfront, you'll need to reconcile it on your income tax return using the exact same kind that's utilized to claim the subsidy by individuals who paid complete price during the year ). Premiums are set charges that must be paid monthly. If your premiums are up to date, you are insured.

Little Known Questions About Which One Of These Is Covered By A Specific Type Of Insurance Policy?.

Deductibles, according to Healthcare. gov, are "the quantity you pay for covered health care services before your insurance strategy starts to pay." But it is essential to comprehend that some services can be completely or partially covered before you meet the deductible, depending on how the strategy is created. ACA-compliant plans, consisting of employer-sponsored strategies and specific market plans, cover particular preventive services at no charge to the enrollee, even if the deductible has actually not been met.

Rather of having the enrollee pay the full expense of these visits, the insurance coverage strategy might need the member to just pay a copay, with the health insurance getting the rest of the expense. However other health strategies are created so that all servicesother than the mandated preventive care benefitsare used towards the deductible and the health insurance does not start to spend for any of them till after the deductible is fulfilled.

Even if your health insurance coverage policy has low or no deductibles, you will probably be asked to pay a fairly low cost for healthcare. This fee is called a copayment, or copay for brief, and it will typically differ depending upon the specific medical service and the information of the individual's plan. how long can my child stay on my health insurance.

Some plans have copays that just apply after a deductible has actually been fulfilled; this is progressively typical for prescription advantages. Copayments may be greater if month-to-month premiums are lower. Healthcare.gov explains coinsurance as follows: "the percentage of expenses of a covered health care service you pay (20%, for example) after you have actually paid your deductible.

If you have actually paid your deductible, you pay 20% of $100, or $20." Coinsurance generally uses to the exact same services that would have counted towards the deductible prior to it was met. To put it simply, services that go through the deductible will be subject to coinsurance after the deductible is met, whereas services that go through a copay will typically continue to go through a copay.

10 Simple Techniques For How Much Does Life Insurance Cost

The yearly out-of-pocket optimum is the greatest total amount a medical insurance business needs a patient to pay themselves towards the overall expense of their healthcare (in basic, the out-of-pocket maximum only uses to in-network treatment for covered, medically-necessary care in which any previous authorization guidelines are followed). As soon as a patient's deductibles, copayments, and coinsurance spent for a particular year amount to the out-of-pocket optimum, the client's cost-sharing requirements are then ended up for that specific year.

So if your health insurance has 80/20 coinsurance (indicating the insurance coverage pays 80% after you have actually satisfied your deductible and you pay 20%), that doesn't suggest that you pay 20% of the overall charges you sustain. It means you pay 20% until you hit your out-of-pocket optimum, and after that your insurance will begin to pay 100% of covered charges.

Insurance coverage premium is a defined amount stated by the insurer, which the insured person should periodically pay to maintain the actual coverage of insurance coverage. As a process, insurance companies examine the kind of coverage, the possibility of a claim being made, the location where the policyholder lives, his work, his routines (smoking cigarettes for example), his medical condition (diabetes, heart ailments) among other aspects.

The higher the risk related to an occasion/ claim, the more costly the insurance coverage premium will be. Insurance coverage business use policyholders a number of choices when it pertains to paying insurance coverage premium. Insurance policy holders can generally pay the insurance coverage premium in installments, for example regular monthly or semi-annual payments, or they can even pay the whole amount upfront before protection starts.

How To Read Blue Cross Blue Shield Insurance Card Can Be Fun For Anyone

By comprehending what a medical insurance deductible is, you can learn how to minimize your healthcare expenditures. What is a deductible and how can it impact the expense of your healthcare? A deductible is the amount you pay out of pocket for medical services prior to your medical insurance plan starts to cover its share of the expenditures.

Deductibles are a staple in the majority of health insurance coverage strategies, and how much you pay toward your deductible differs by plan. According to Investopedia, "If you get into an accident and your medical expenditures are $2,000 and your deductible is $300, then you would have to pay the $300 out of pocket first prior to the insurer paid the remaining $1,700.

In addition to deductibles, there are other out-of-pocket expenses you may be accountable for paying when you receive health insurance coverage. Out-of-pocket costs include deductibles, coinsurance, and copays." is a method for you to share your healthcare costs with your insurance provider. Your coinsurance can be anything from 50/50 to 80/20 depending upon the kind of insurance plan you select.

This suggests that a $500 procedure will just cost you $250 and the other $250 will be paid by your insurer (what is a deductible health insurance). In the case of an 80/20 coinsurance, that exact same $500 procedure will only cost you $100, and your insurer will pay the other $400. A, or, is a flat charge that you pay for particular healthcare services as soon as you have actually met your deductible.

How How Much Is Long Term Care Insurance can Save You Time, Stress, and Money.

A copayment is an established cost for specific health care services that is required at the time you receive care. While most health insurance coverage strategies consist of a deductible, how high or low your deductible is can differ. Usually, there are two kinds of plans:, or; and, or.

For you, the benefit can be found in lower month-to-month premiums. If you have a high-deductible strategy, you are qualified for a (). These accounts enable you to reserve a limited amount of pre-tax dollars for medical costs. In the case of employer-sponsored health insurance coverage, companies may contribute to their employees' HSAs, sometimes even matching employee contributions, causing significant pre-tax cost savings.

Since the cash in your HSA isn't taxed like the rest of your earnings, it serves a double function: helping you set aside cash to cover health care costs and decreasing your tax problem." Because HDHPs' month-to-month premiums are normally low, it can be affordable to individuals who are normally healthy and don't need to go to a doctor except for annual exams or preventive care.

These preventive services consist of: Abdominal aortic aneurysm screeningAlcohol abuse screening and counselingAspirin useBlood pressure screeningCholesterol screeningColorectal cancer screeningDepression screening Type 2 diabetes screeningDiet counselingHIV screeningImmunization vaccinesObesity screening and counselingSexually Transferred Infection (STI) prevention counselingTobacco usage screening and cessation interventionsSyphilis screeningOn the other hand, a can be useful for people and families who need to frequently or routinely check out medical professionals, professionals, and hospitals for care.

Getting The How Much Does Flood Insurance Cost To Work

However you'll pay a much higher premium for these plans. Though specifics vary by area and strategy details, a low-deductible strategy can cost at least twice as much per month as a high-deductible strategy." In short, if you're wanting to keep your monthly premiums low, you might select an HDHP.

No matter which type of strategy you have an interest in, HealthMarkets can help you discover the ideal one for your family. what is a deductible health insurance. Contact us today to discuss your unique health requirements and compare your choices. No matter how high or low your health policy's deductible is, having the alternative to lower how much you pay of pocket can assist https://topsitenet.com/article/626296-what-does-how-to-get-insurance-to-pay-for-water-damage-do/ out any family's budget.

The Premium Tax Credit is an aid that assists households making a modest earnings pay for the cost of their month-to-month premiums. You can get this aid in one of 2 ways: You can have this credit paid to your insurer from the federal government to assist lower or cover the expense of your month-to-month premiums; orYou can claim the whole amount of credit you're qualified for in your yearly tax return.

You must not be eligible for Medicaid, Medicare, CHIP, or TRICARE.You can not have access to budget-friendly coverage through your company's plan. You must not be claimed as a reliant by another person. The Cost-Sharing Reduction is an extra subsidy that assists families making a modest earnings afford out-of-pocket expenditures when getting healthcare.

Excitement About What Is Deductible In Health Insurance

In order to be qualified for this decrease, you should satisfy these requirements: You must have a combined annual family earnings between 100 percent and 250 percent of the Federal Poverty Line. You must be enrolled in a Silver-tiered health plan. Desire to see if you're gotten approved for a health insurance aid! .?. !? Talk to a licensed HealthMarkets agent today to see if your family fulfills the requirements for reduced monthly premiums or out-of-pocket costs.

Make sure you can pay for to pay the premiums for the insurance strategy you select, along with cover the deductible and any copayments or coinsurance that may be required. Check to see what medical services apply to the deductible. There are likely some medical services that the insurance strategy will assist cover, even if you have not yet met your deductible.

Let a licensed representative help you comprehend. When you're prepared to read more about what a deductible is, and get the protection your household requires, contact HealthMarkets. With our Finest Price Assurance, we're confident we can discover inexpensive health care alternatives with medical insurance suppliers regional to youand most importantly, we'll do it for free.

Contact us online to get a complimentary quote, fulfill with among our certified agents in person, or call us at. Let's get you enrolled in a cost effective health strategy today. Recommendations:" Meaning of 'Deductible' Investopedia." "Meaning of 'Coinsurance' Investopedia." "Meaning of 'Copay' Investopedia." "Should I Pick A High Or Low Deductible Medical Insurance Strategy? Forbes." 2014.

How To Get Cheap Car Insurance Fundamentals Explained

" Concerns and Answers on the Premium Tax Credit Internal Revenue Service." 2015. "In Addition To Premium Credits, Health Law Provides Some Consumers Help Paying Deductibles And Co-Pays Kaiser Health News." 2013. "Describing Health Care Reform: Concerns About Health Insurance Coverage Subsidies KFF." 2014.

This weekly Q&A addresses concerns from genuine clients about healthcare expenses. Have a concern you wish to see answered? Send it to AskChristina@nerdwallet. com. I am going shopping the federal Marketplace for a new health insurance plan. Though I comprehend the essentials of health insurance coverage, deductibles have me confused. I am the sole income producer, living in Houston with an other half and two young kids.

Given these situations, should I choose a high-deductible strategy to conserve cash on monthly premiums or a low-deductible plan with higher premiums? Deductibles are a typical source of confusion, and with the large array of options in the Market, your problem selecting the best strategy is reasonable. Understanding how high- and low-deductible plans work, how month-to-month premiums play into your decision and how these strategies can impact your protection will help guarantee your household has the most appropriate healthcare plan in the coming year.

The Ultimate Guide To What Is The Fine For Not Having Health Insurance

A policy's cash value can provide various benefits that you can use while you're still alive. It can take some time for it to become an useful quantity, however when that occurs, you can obtain cash against your policy's cash worth, use it to pay premiums, or perhaps surrender it for cash in retirement.

While there's no assurance that dividends will be stated each year, Guardian has actually paid them every year since 1868, even throughout wars, pandemics, or stock market turbulence. Depending on your needs, you can decide to utilize your dividends in various ways. One option is to purchase paid-up additions (PUAs). 7 A PUA is guaranteed permanent, paid-up life insurance.

Dividend build-ups can likewise be withdrawn tax-free, approximately the policy basis (i. e., the sum of premiums paid to date). In addition to purchasing PUAs, Guardian offers policyholders these dividend choices: Get in money Minimize premium Purchase extra term insurance coverage Accumulate with interest Apply to outstanding policy loans Here's how the survivor benefit of a whole life policy can grow with paid-up extra insurance coverage purchased by dividends.

Whole life insurance coverage is a long-term policy, which offers you guaranteed defense for your enjoyed ones that lasts a life time. With whole life insurance coverage, unlike term, you make ensured cash value, which you can use however you want. Taking part whole life insurance coverage is qualified to make dividends,1 which can increase the survivor benefit and the cash value of the policy.

The smart Trick of How Long Can You Stay On Your Parents Insurance That Nobody is Talking About

Retirement and your monetary future. Hmm. you'll navigate to thinking about it one day. And life insurance? That too. But here's the funny aspect of lifewe can't manage it. Things happen that we never ever see coming, and there's very little we can in fact prepare for. That's why it's so crucial to get things in location today that we can controllike life insurance.

When you boil things down, you actually have two choices when it comes to life insuranceterm vs. whole life. One is a safe plan that assists protect your household and the other one, well, it's a total rip-off. Term life insurance offers life insurance protection for a particular quantity of time.

Term life insurance plans are much more cost effective than entire life insurance coverage. This is since the term life policy has no money value up until you or your partner passes away. In the simplest of terms, it's not worth anything unless among you were to die throughout the course of the term.

Obviously, the hope here is you'll never ever need to use your term life insurance policy at allbut if something does occur, a minimum of you know your family will be taken care of. The premiums on whole life insurance (sometimes called cash value insurance) are usually more pricey than term life for a couple of reasons.

What Does Comprehensive Auto Insurance Cover Things To Know Before You Buy

It may seem like a good idea to have life insurance protection for your entire life. However here's the reality: If you practice the principles we teach, you will not need life insurance coverage permanently. Eventually, you'll be self-insured. Why? Due to the fact that you'll have zero debt, a full emergency situation fund and a hefty amount of money in your investments.

It resembles Dave states in his book The Total Guide to Cash, "Life insurance has one job: It replaces your income when you die." There are even more efficient and successful ways to invest your money than using your life insurance coverage strategy. What noises like more fun to youinvesting in development stock shared funds so you can enjoy your retirement or "investing" money in a strategy that's all based upon whether or not you bite the dust? We think the response is quite easy.

He search and discovers he can acquire an average of $125,000 in insurance for his household. From the whole life insurance coverage agent, he'll most likely hear a pitch for a $100 per month policy that will construct up cost savings for retirement, which is what a cash value policy is supposed to do.

So, if Greg chooses the entire life, cash value choice, he'll pay a large monthly premium. And the part of his premium that isn't going towards in fact guaranteeing him, goes towards his cash value "investment," right? Well you 'd think, but then come the charges and costs. That extra $82 monthly disappears into commissions and costs for the first three years.

Little Known Facts About How Much Is Health Insurance A Month For A Single Person?.

Even worse yet, the savings he does handle http://crweworld.com/article/news-provided-by-accesswire/1677148/deadline-for-scholarship-opportunities-from-wesley-financial-group-approaching to develop after being ripped off for 20 years will not even go to his household when he dies - how much renters insurance do i need. Greg would require to withdraw and invest that money value while he was still alive. Talk about pressure! The only benefit his household will get is the stated value of the policy, which was $125,000 in our example.

That's a great deal of bang for your dollar! You need to buy a term life insurance policy for 1012 times your yearly income. That method, your income will be changed for your family if something takes place to you - how to cancel state farm insurance. You can run the numbers with our term life calculator. And don't forget to get term life insurance coverage for both spouses, even if among you remains at house with the kids.

Desire to ensure your family is covered no matter what happens? Look at your protection prior to it becomes an emergency situation. Take our 5-minute protection examination to ensure you have what you require. Dave recommends you purchase a policy with a term that will see you through till your kids are heading off to college and living on their own.

A great deal of life can happen in twenty years. Let's state you get term life insurance coverage when you're thirty years old - how much is long term care insurance. You and your partner have a lovable little two-year-old young child running around. You're laser-focused on paying off all your debt (including the home) and anticipate investing and retirement preparation in the future.

A Biased View of What Is Group Term Life Insurance

The years passed quickly, didn't they? However look where you are! You're debt-free (your home and whatever), and with your 401( k), cost savings and mutual funds, you're sitting at a cool net worth of $500,0001. 5 million! The years were great to you, and it's all due to the fact that you had a strategy.

At this point, (even without life insurance) if something were to occur to you or your partner, the making it through spouse would be able to live off your savings and financial investments. Congratulations, you've ended up being self-insured! When you end up being more financially safe, you have less and less of a requirement for life insurance coverage.

Life is precious! And the ideal time to purchase life insurance is when you're young and have a clean costs of health. Specifically because life insurance coverage business are https://www.instagram.com/accounts/login/?next=/wesleyfinancialgroupllc/%3Fhl%3Den all about weighing the dangers of the individual acquiring the policy. Zander Insurance is the only company that Dave Ramsey suggests for term life insurance coverage.

Compare Policies With 8 Leading Insurance providers Whole life insurance is one kind of long-term life insurance that can offer long-lasting protection. It offers a range of guarantees, which can be attracting someone who does not want any guesswork after purchasing life insurance coverage. Whole life insurance coverage combines a financial investment account called "money value" and an insurance coverage product.

The Buzz on How Many People Don't Have Health Insurance

These policies would usually cost more in advance, since the insurance company needs to develop adequate cash worth within Additional info the policy during the payment years to money the policy for the remainder of the insured's life - how much is adderall without insurance. With Getting involved policies, dividends might be applied to reduce the premium paying period.

These policies usually have charges during early policy years must the insurance policy holder cash it in. This type is relatively brand-new, and is also understood as either "excess interest" or "present presumption" entire life. The policies are More help a mix of standard whole life and universal life. Instead of using dividends to augment guaranteed money value accumulation, the interest on the policy's money worth differs with existing market conditions.

Like universal life, the premium payment may vary, but not above the optimal premium ensured within the policy. Whole life insurance coverage usually requires that the owner pay premiums for the life of the policy. There are some arrangements that let the policy be "paid up", which implies that no more payments are ever required, in as couple of as 5 years, or with even a single large premium.

However, some whole life contracts provide a rider to the policy which permits a one time, or periodic, big extra premium payment to be made as long as a very little additional payment is made on a routine schedule. In contrast, universal life insurance usually enables more versatility in exceptional payment.

The 8-Minute Rule for How Does Health Insurance Deductible Work

The dividends can be taken in one of 3 ways. The policy owner can be offered a cheque from the insurance coverage business for the dividends, the dividends can be utilized to decrease the premium payment, or the dividends can be reinvested back into the policy to increase the death benefit and the money worth at a quicker rate.

The money value will grow tax-deferred with intensifying interest. Despite the fact that the growth is considered "tax-deferred," any loans drawn from the policy will be tax-free as long as the policy stays in force. In addition, the death benefit stays tax-free (indicating no earnings tax and no estate tax) - how to get therapy without insurance. As the cash worth boosts, the survivor benefit will likewise increase and this growth is also non-taxable.

Most entire life policies can be given up at any time for the money worth quantity, and earnings taxes will normally just be put on the gains of the money account that exceeds the total premium investment. Hence, many are utilizing whole life insurance policies as a retirement funding automobile rather than for risk management.

A lot of companies will transfer the cash into the policy holder's savings account within a few days. Money values are likewise liquid sufficient to be utilized for investment capital, but only if the owner is financially healthy sufficient to continue making superior payments (Single premium entire life policies prevent the threat of the insured stopping working to make premium payments and are liquid adequate to be used as collateral.

Fascination About How Long Can I Stay On My Parents Insurance

Due to the fact that these policies are fully paid at beginning, they have no monetary risk and are liquid and protected sufficient to be utilized as security under the insurance stipulation of collateral task.) Money worth gain access to is tax free approximately the point of total premiums paid, and the rest may be accessed tax complimentary in the form of policy loans.

If the insured passes away, survivor benefit is lowered by the amount of any outstanding loan balance. Internal rates of return for participating policies may be much worse than universal life and interest-sensitive entire life (whose cash worths are bought the cash market and bonds) since their cash worths are bought the life insurance company and its general account, which might be in realty and the stock exchange.

Variable universal life insurance coverage might surpass whole life since the owner can direct financial investments in sub-accounts that might do much better. If an owner desires a conservative position for his money worths, par whole life is suggested. Reported money values might appear to "disappear" or end up being "lost" when the survivor benefit is paid.

The insurance provider pays out the cash worths with the survivor benefit since they are inclusive of each other. This is why loans from the money value are not taxable as long as the policy is in force (due to the fact that survivor benefit are not taxable). Life Insurance Coverage, a Customer's Handbook/ Belth second ed p23 Life Insurance, a Consumer's Handbook/ Belth 2nd ed p22 Tax Realities/ The National Underwriter 2015 Ed p39 Tax Realities/ National Underwriter 2015 Ed P32 IRC Sec 2042 " Businesses - Life Occurs".

How Much Is Urgent Care Without Insurance Fundamentals Explained

Life Insurance/ Huebner & Black Ch 3 Life Insurance/Huebner & Black 9th ed P6 Life Insurance/ Huebner & Black 9th Ed P 277-279 Alexander B. Grannis, Chair. how do health insurance deductibles work. http://charlieahic062.tearosediner.net/the-ultimate-guide-to-how-to-check-if-your-health-insurance-is-active-online " The Feeling's Not Shared". New York City State Assembly. Recovered 2007-01-15. "Life Insurance Coverage" Huebner & Black/ 9th ed p320 BEST'S FLITCRAFT 1985 Ed P561 " A Guide to Life Insurance Coverage".

Archived from the initial on 2006-12-10. Recovered 2007-01-16. " glossary". Life and Health Insurance Coverage Foundation for Education. Retrieved 2007-01-15. Florida Life and Health Study Handbook, 12 edition " Whole Life Insurance". The Property Protection Book. Archived from the original on 2007-01-14. Recovered 2007-01-17.

Whole life insurance coverage is a permanent insurance coverage guaranteed to stay in force for the life of the guaranteed as long as premiums are paid. When you first apply for coverage, you are accepting an agreement in which the insurance coverage business assures to pay your beneficiary a certain quantity of money called a survivor benefit when you pass.

As long as you pay your premiums, your entire life insurance policy will remain in impact and your premiums will stay the exact same regardless of health or age modifications. For example, let's say you buy an entire life insurance coverage policy at age 40. When you buy the policy, the premiums will be locked in for the life of the policy as long as you pay them.

Some Known Details About How Do I Get Health Insurance

Unlike term insurance, entire life policies do not expire. The policy will remain in result until you pass or till it is cancelled. Gradually, the premiums you pay into the policy start to create cash worth, which can be used under certain conditions. Money value can be withdrawn in the form of a loan or it can be used to cover your insurance coverage premiums.

Entire life policies are one of the few life insurance coverage prepares that produce cash worth. Cash worth is produced when premiums are paid the more premiums that have actually been paid, the more money value there is. The primary benefit of money value is that it can be withdrawn in the kind of a policy loan.

As long as the loan and any interest is repaid, your policy's full protection amount will be paid out to your beneficiary. If the loan isn't paid back, the survivor benefit will be lowered by the impressive balance of the loan. While whole life insurance coverage policies function as a financial investment vehicle of sorts because of the money value they accumulate, you shouldn't see any type of life insurance coverage as an investment.